Which Describes Annual Income Guidelines Established by the Federal Government

Many government aid programs use a different poverty measure the Department of Health and Human Services HHS poverty guidelines or variants thereof. Which of the following is TRUE regarding the federal income tax liability owed.

Pin By Aimee Faust On Home Loan Products Fha Loans Real Estate Tips Home Buying Process

Can estimate on an annual basis the cost to maintain and preserve the infrastructure assets at the disclosed condition level.

. While the guidelines stop at households of eight additional people are counted by adding 4500-5700 to the allowable household annual income. 14 The official measure of poverty was established by OMB in Statistical Policy Directive 14 is designed to be used by federal agencies in their. Which describes annual income guidelines established by the federal government.

Federal Poverty Level FPL - The Federal Poverty Level is a scale to judge whether or not a familys income meets the financial needs for the basic necessities of life. OMB Statistical Policy Directive No. Temporary Assistance for Needy Families Question 10.

Medically needy Medicaid program c. The History of Measuring Poverty in America. Supplemental Security Income d.

Persons in Family Household. In the absence of a pronouncement covered. Among the most important types of communication is the annual financial report which presents the financial position operating results and cash flows for a particular accounting period.

In order to fund the Civil War the Revenue Act of 1862 imposed a 3 tax on the incomes of citizens earning more than 600 per year and 5 on those making over 10000. Department of Health and Human Services Poverty Guidelines 2019 Annual Income. 48 Contiguous States and District of Columbia.

Moreover a family of four that earns 26000-33000 per year is currently considered to be living at the poverty level. Income guidelines established annually by the federal government. Law 111-352 Government Performance and Results Act Modernization Act of 2010 GPRAMA.

The guidelines are a simplification of the poverty thresholds for use for administrative purposes for instance determining financial eligibility for certain federal programs. For example in 2022 the FPL is 13590 for an individual 18310 for a family of. Research Analysis Background.

Federal poverty level Which program added prescription medication coverage to the original Medicare plan some Medicare cost plans some Medicare private fee-for-service plans and Medicare medical Savings Account Plans. Annual reviews and reports pursuant to Pub. Below are the Departments annual adjustments to the Income Eligibility Guidelines IEGs to be used in determining eligibility for free and reduced price meals or free milk.

There is no relationship between federal and state income taxes. A flat tax of 10 is owed on all proceeds. New guidelines are issued every year in late January or early February to account for fiscal changes such as higher utility costs inflation and minimum wage levels.

Practices that are widely recognized and prevalent in state and local government are included in this category. The Internal Revenue Service IRS is the revenue service for the United States federal government which is responsible for collecting taxes and administering the Internal Revenue Code the main body of the federal statutory tax lawIt is part of the Department of the Treasury and led by the Commissioner of Internal Revenue who is appointed to a five-year term by the. Federal poverty level bmedically needy Medicaid program c.

Of annual income in 24 CFR 56094 and using adjusted gross income as defined for purposes of reporting under Internal Revenue Service Form 1040 series for individual federal annual income tax purposes. Supplemental Security Income dTemporary Assistance for Needy Families. After the law was allowed to expire in 1872 the federal government depended on tariffs and excise taxes for most of its revenue.

Temporary Assistance for Needy Families TANF makes cash assistance available on a time-limited basis for children deprived of support because of a parents death incapacity absence or unemployment. Annual performance plans and reports pursuant to Pub. Methods for Income Determination.

The entity documents that the eligible infrastructure assets are being preserved approximately at or above a condition level. Which describes annual income guidelines established by the federal government. Federal income tax is based on your annual income while state income tax is determined by the number of children the taxpayer has d.

Which describes annual income guidelines established by the federal government. Question Which describes annual income guidelines established by the federal government. The poverty guidelines are sometimes loosely referred to as the federal poverty level FPL but that phrase is ambiguous and should be avoided especially in situations eg.

The guidelines are a simplification of the poverty thresholds for use for administrative purposes for instance determining financial eligibility for certain federal programs. The FPL is a measure of income issued annually by the federal Department of Health and Human Services that takes into account the number of people living in a household. These guidelines are used by schools institutions and facilities participating in the National School Lunch Program and USDA Foods in Schools School Breakfast Program.

Federal income tax is based on your annual income while state income tax is generally a specific percentage of federal. Annual evaluations and reports pursuant to the Federal Information Security Modernization Act of 2014 PDF and OMB Circular A-130. Terms in this set 23.

Federal poverty level b. The poverty guidelines are sometimes loosely referred to as the federal poverty level FPL but that phrase is ambiguous and should be avoided especially in situations eg.

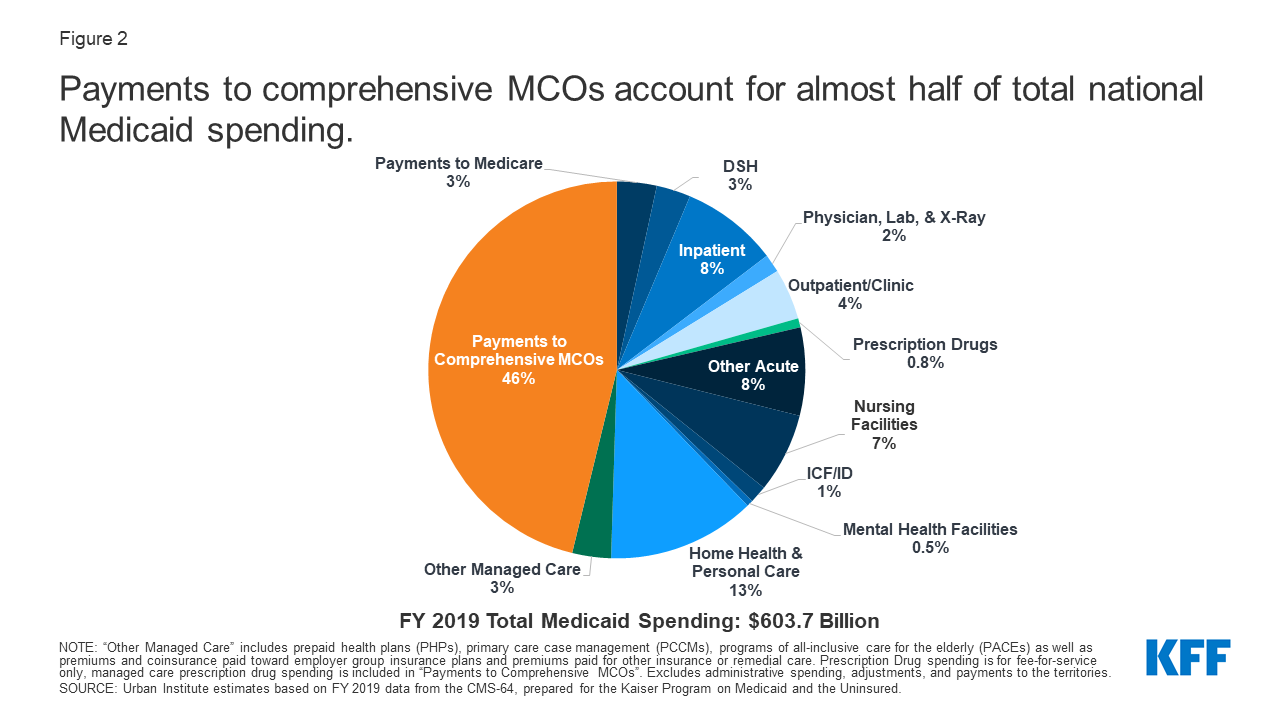

Medicaid Financing The Basics Issue Brief 8953 03 Kff

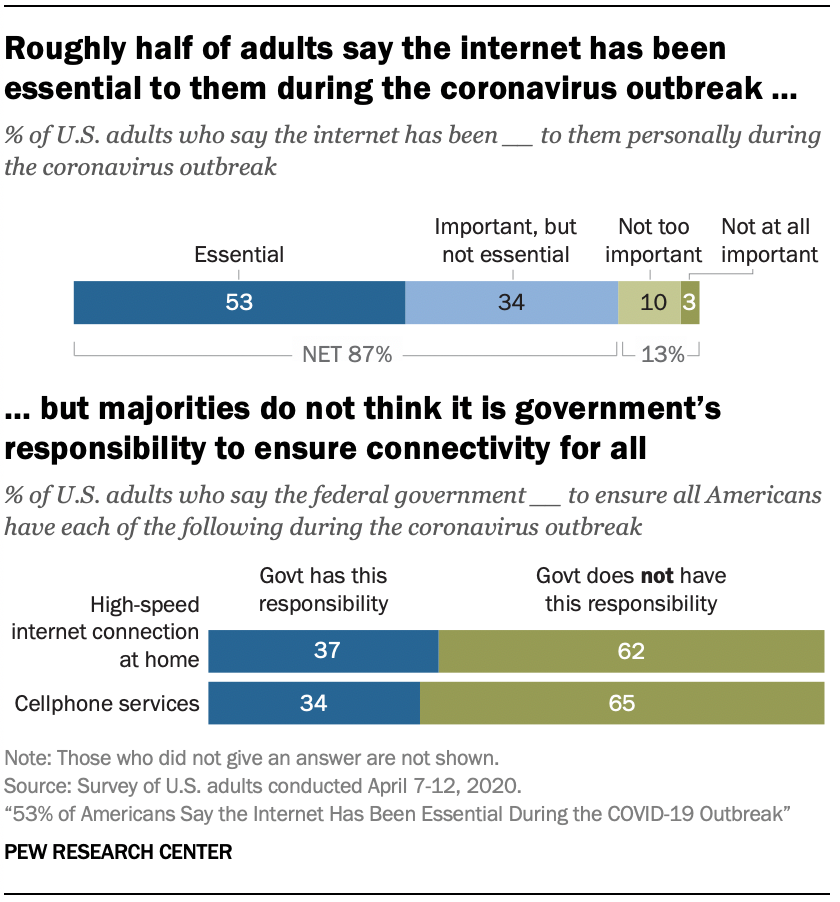

53 Of Americans Say Internet Has Been Essential During Covid 19 Outbreak Pew Research Center

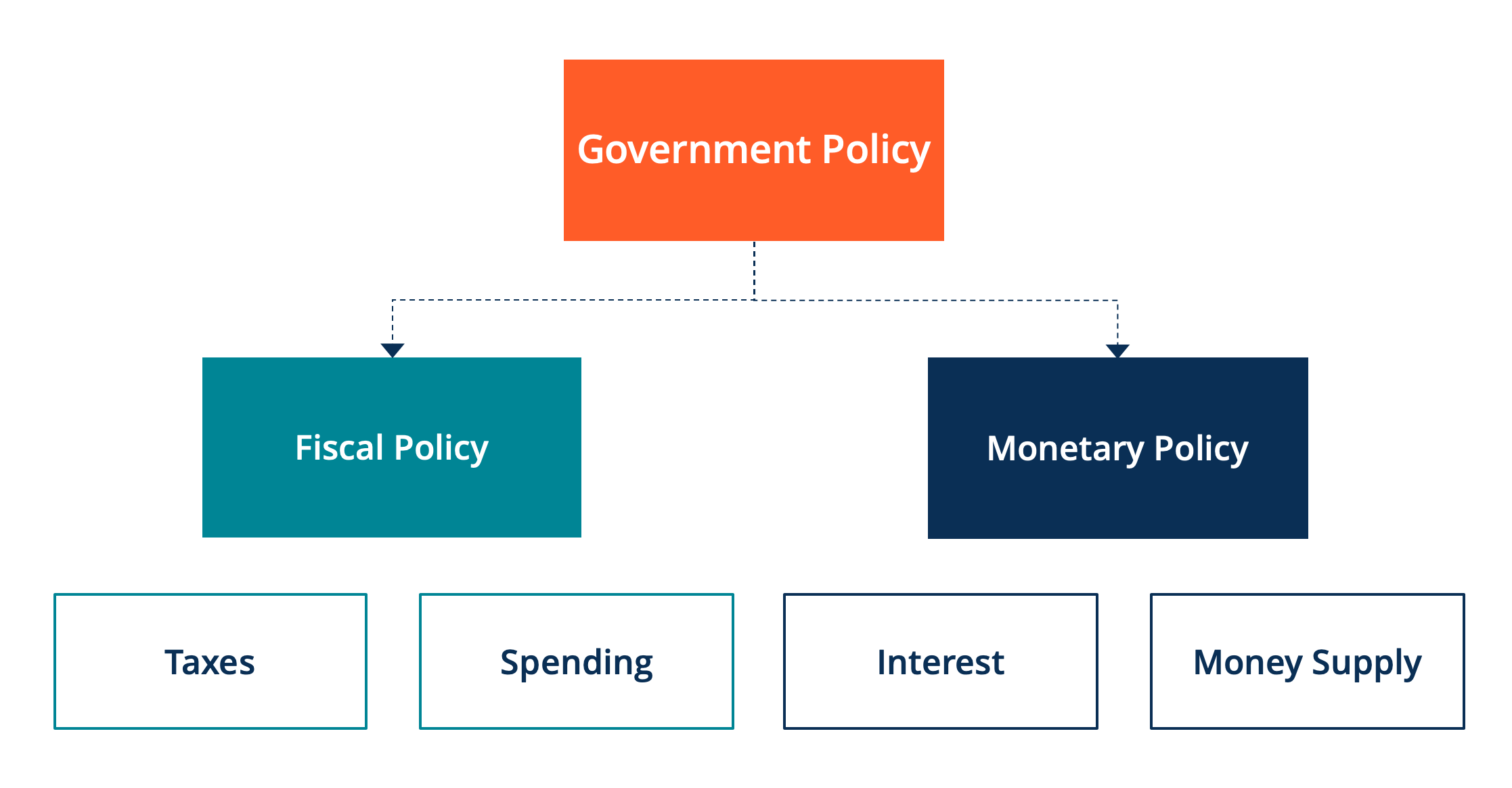

Fiscal Policy Overview Of Budgetary Policy Of The Government

What Types Of Federal Grants Are Made To State And Local Governments And How Do They Work Tax Policy Center

The Truth Behind Welfare Dependency World Economic Forum

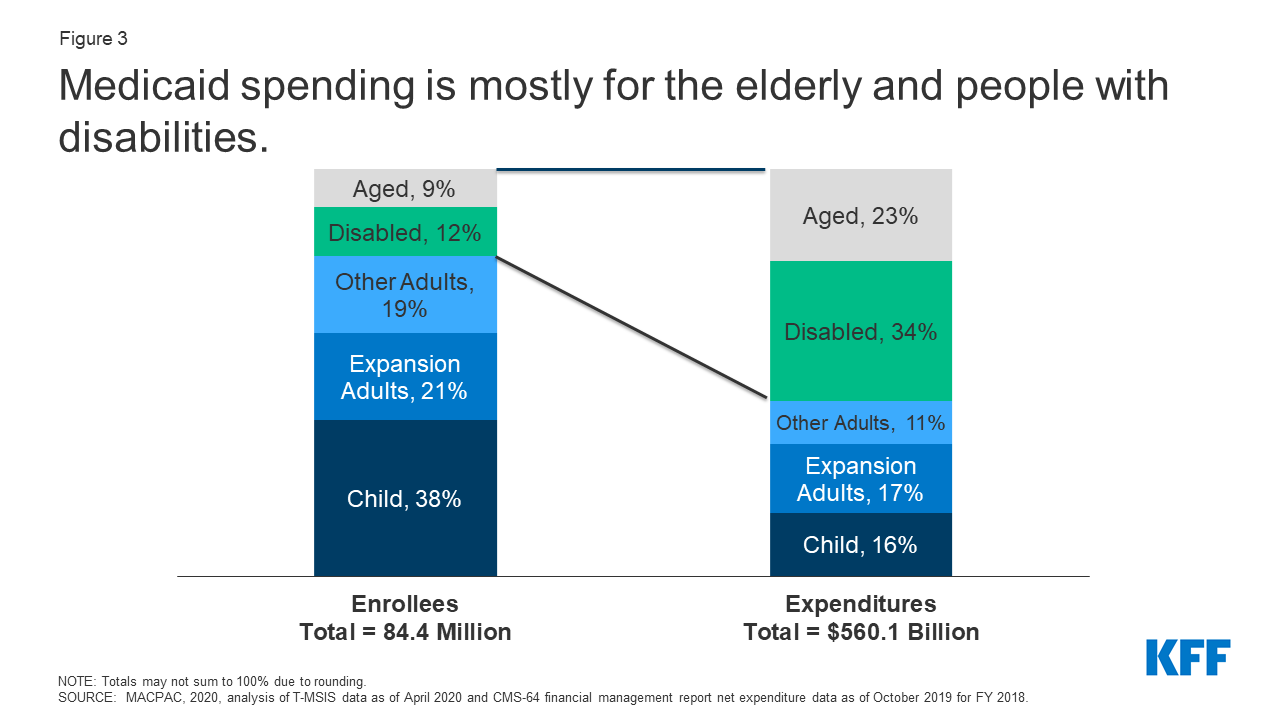

Medicaid Financing The Basics Issue Brief 8953 03 Kff

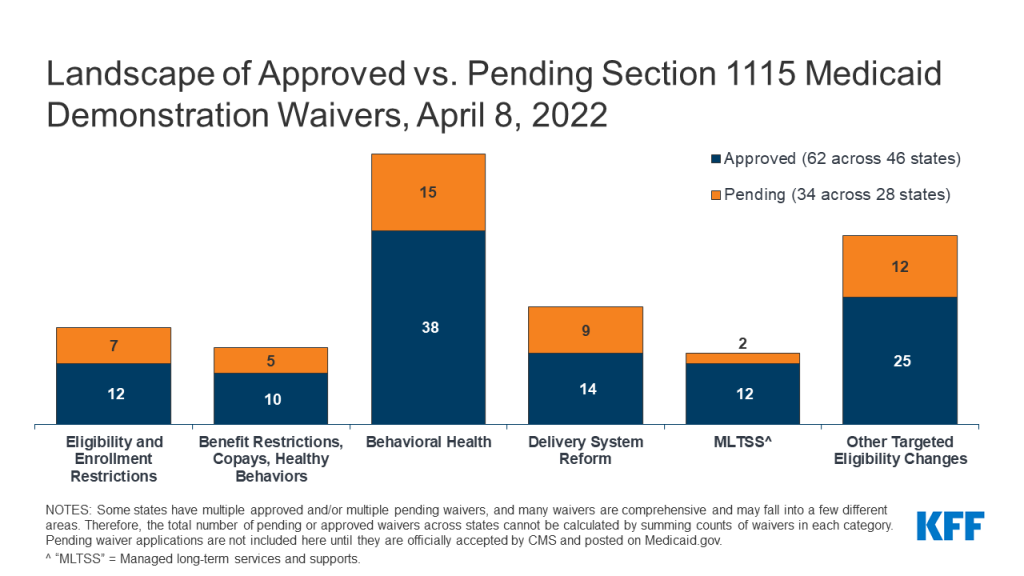

10 Frequently Asked Questions About Medicaid Expansion Center For American Progress

What Is An Llc What Are The Advantages And Disadvantages If You Are Starting Up A New Business Selling Your Soc Business Finance Business Savvy Business Tips

Chart Of Accounts In Technical Notes And Manuals Volume 2011 Issue 003 2011

Russia Central Bank Hikes Interest Rates To 20 To Bolster Ruble

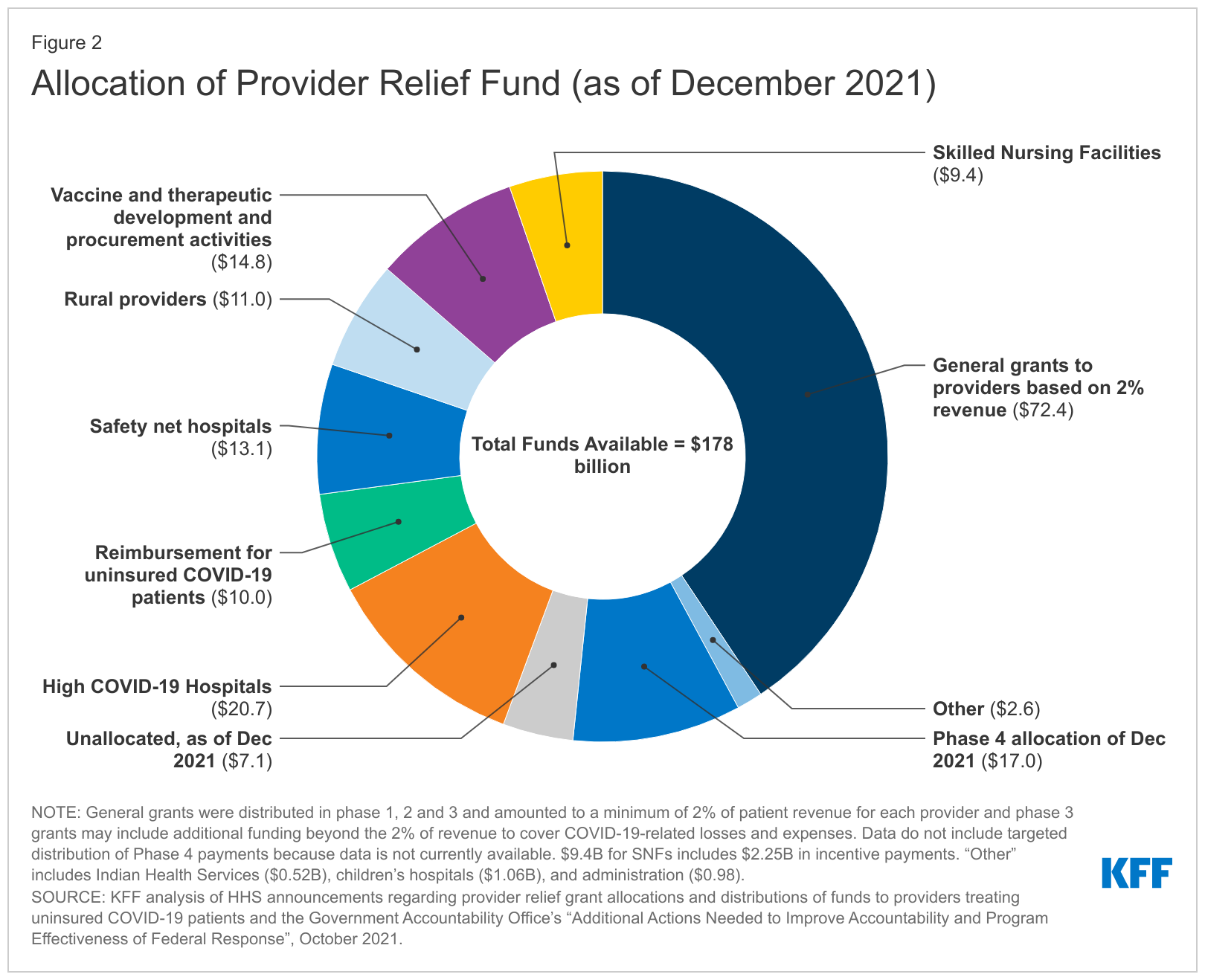

Funding For Health Care Providers During The Pandemic An Update Kff

Kentucky Fha Loan Requirements For 2022 Fha Loans Fha Fha Mortgage

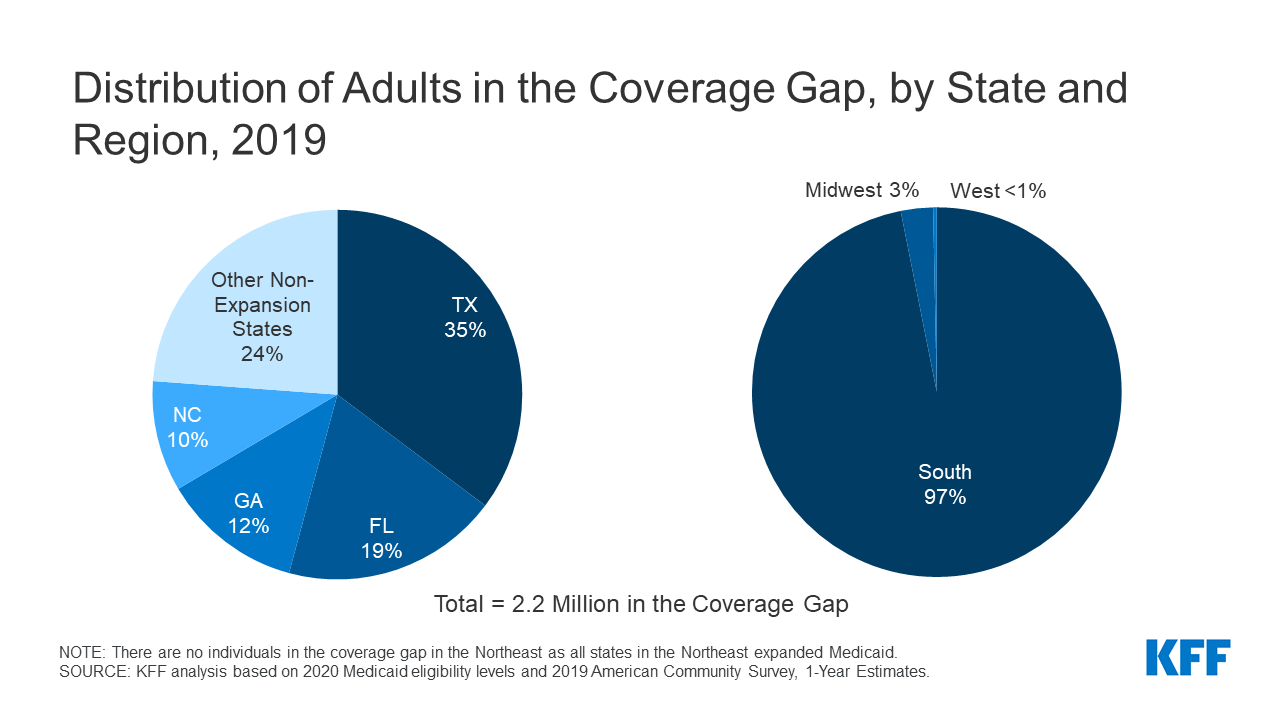

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

Understanding Medical Coding And Billing Chapter 15 Medicaid Flashcards Quizlet

Federal Subsidies For Health Insurance Coverage For People Under 65 2020 To 2030 Congressional Budget Office

/GettyImages-863549628_1800-7c156f7111064920b2c9f38457a90c56.png)

Comments

Post a Comment